Addressing the Root Cause of Retail’s Inventory Glut: Three Strategies for Better Inventory Management

Earlier this year in our 2023 Retail Industry Outlook we referenced an insightful survey of supply chain executives. In this survey, 41% of respondents expressed their belief that the supply chain would not stabilize to pre-pandemic levels until the second half of 2023, and 53% said they expected disruptions to last through 2024 or later.

We’re now halfway through 2023 and these projections are coming to a head. Currently, one of the biggest impediments to the supply chain’s return to normalization has been the retail industry’s inventory glut. Over the past few years, in response to pandemic-induced supply chain shortages and delays, retailers compensated by overordering inventory in hopes of preventing out-of-stocks.

While this strategy achieved its aim, retailers drastically overestimated consumer demand levels, particularly in discretionary categories like furniture and apparel. As a result, retailers accumulated a costly amount of inventory that far exceeds current consumer demand (a phenomenon sometimes referred to as the “bullwhip effect”).

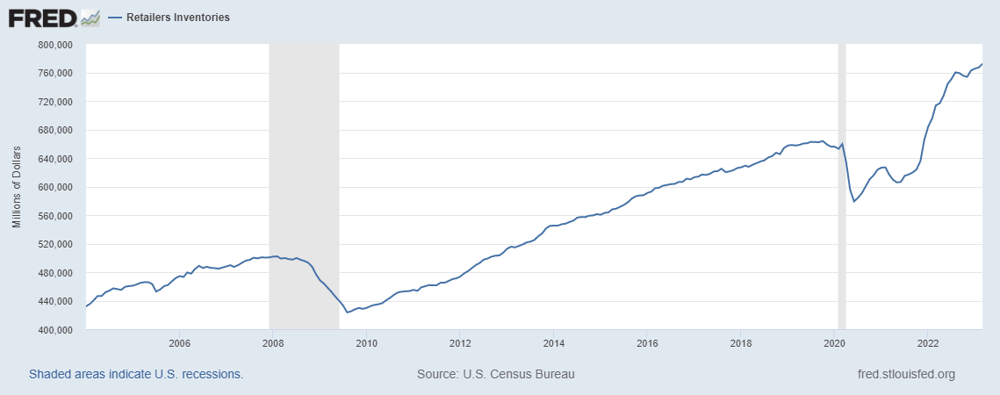

The graph below from Federal Reserve Economic Data (FRED) tracks retail inventory levels in the United States up to March ’23 and efficiently illustrates the severity of the glut:

Over the course of 2022, retail inventory levels increased by $80 billion, a historically unprecedented jump. And for the past year and a half, retailers have desperately attempted to mitigate the effects of this excess inventory through two primary strategies: warehousing and product markdowns.

These two strategies have been necessary for slowing the bleeding in the short-term, but they are not sustainable solutions—both eat into already-thin profit margins, and long-term storage is not a feasible solution for time-sensitive categories. But most importantly, these strategies fail to address the root cause of inventory glut.

Proactive Solutions for Long-Term Inventory Stability

The root cause of inventory glut is not uncontrollable disruptions to the supply chain or unpredictable swings in consumer preferences, it is the reactive and siloed approach that has become commonplace in the retail industry.

The only way to prevent future inventory gluts from occurring is for the industry to adopt a more forward-looking, data-driven, and collaborative approach to inventory management. Reactive strategies like warehousing and markdowns will always have their place, but they are best thought of as complementary aids in the pursuit of optimized inventory levels, not stand-alone solutions.

The following three strategies, however, serve as the foundation for long-term inventory stability. By prioritizing data quality, cross-organizational collaboration, and executional excellence, the retail industry can better anticipate and respond to future disruptions.

1) Demand Forecasting: Relying Less on Historical Data

Let’s get the most obvious strategy out of the way first. If you want to better align supply and demand levels, accurate forecasting is essential. As discussed in the first edition of Shelf Help, it is imperative not to rely too heavily on historical buying data to inform your future ordering.

Consumer preferences—largely influenced by rapid socio-economic changes—are volatile and difficult to predict. Apparel companies, for example, drastically overestimated demand for athleisure styles in 2022 because they over-weighted their projections on mid-pandemic consumer buying behaviors and did not anticipate the sudden consumer shift toward more formal attire (and even if they did see it coming, they did not anticipate the shift happening so quickly and suddenly).

The only way to safeguard demand forecasting accuracy against outdated buying indicators is to inform forecasting algorithms with the most up-to-date data available: actual in-store stock quantities and on-shelf availability. And the best way to attain this real-time data is to empower the frontline teams who are closest to it.

By equipping floor level employees with mobile retail execution software, for example, retail teams can capture valuable on-shelf data that would otherwise be a rough estimate. (Due to the prevalence of shrink in retail stores, inventory-on-record rarely aligns with inventory-on-hand. This discrepancy taints forecasting accuracy and exacerbates over/under-ordering.)

With real-time insights into actual on-shelf availability and stock levels by store (with granularity down to the SKU), retailers can more quickly and precisely identify changes in consumer buying behaviors. And because large-batch orders are placed months in advance, every minute matters. Even being able to identify a consumer shift one week sooner can amount to substantial savings.

2) Retail Partner Visibility & Collaboration: More Transparent & Proactive Communication

After cleaning the data that informs demand planning, the next logical step is to share that data with partners. Proactive communication about market trends and anticipated order volumes is critical to aligning the timelines and capacities between retailers, manufacturers, and everyone in between.

The most efficient way to gather and share this data is to implement a digital “control tower”—a centralized, easily accessible repository of data that allows for the quick and effortless interpretation and exportation of data when needed. Ideally, this control tower will integrate with a retailer’s mobile retail execution software to streamline data curation.

This data sharing, however, goes both ways. Just as it is important for retailers to be transparent with their needs, manufacturers must also give retailers transparency into their own production capacities, and so on. With this level of collaboration, retailers will be able to more easily identify early markers of supply disruptions and adjust their ordering strategies appropriately in a timely manner.

The pandemic-induced disruptions to the supply chain shined a spotlight on the importance of proactive cross-organizational communication. The supply chain is on the path to normalization, but there’s no telling when the next disruption will surface. When it does, though, the retailers who prioritized supplier collaboration will be the ones best positioned to keep their inventory levels stable.

3) Retail Execution: More Efficiency & Precision

It’s easy to overlook the role that store-level (or warehouse-level) execution plays in healthy inventory management, but don’t do it.

A team’s ability to quickly and efficiently stock, replenish, and merchandise items in a store (or load and transport items in the case of warehousing and distribution) has a direct impact on corporate-level forecasting.

Delays and missteps in execution at the floor level not only diminish shopper experience (most notably in the form of out-of-stocks, messy shelves, or poor item freshness in the case of perishables) but they also send costly ripples all the way up an organization. Slow speed-to-shelf equates to longer (i.e., more expensive) holding and transportation costs and undermines diligent forecasting efforts that are made months in advance.

The challenge with improving executional efficiency and precision, however, is that retail teams today are overwhelmed with work. The overnight migration of physical and digital retail has turned physical stores into the hubs of both online and in-person shopping. In-store employees, in other words, have more on their hands than ever.

If the retail industry wants to achieve executional excellence, it must empower frontline teams with technology built specifically for today’s retail needs. Intuitive, reliable, and capable mobile solutions that lighten the workload of frontline teams and facilitate efficient execution, collaboration, and data capturing have become indispensable to success in today’s complex, fast-moving store environment.